Federal withholding calculator 2020

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. There are two main methods small businesses can use to calculate federal withholding tax.

How To Calculate Federal Income Tax

All Available Prior Years Supported.

. How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form This number is the gross pay per pay period. Based on your projected tax withholding for the year we can also estimate your tax refund or. 2020 Federal Tax Filing Free Federal IRS 2020 Taxes.

Tax withholding is the money that comes out of your paycheck in order to pay taxes. 250 and subtract the refund adjust amount from that. Your expected tax withholding is.

The Writers Guild-Industry Health Fund and the Producer-Writers Guild of America Pension Plan collectively FundPlan administer health and pension benefits for eligible writers. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Check out HR Blocks new tax withholding calculator and learn about the new W-4 tax form updates for 2020 and how they impact your tax withholdings.

Median household income in 2020 was 67340. Starting in 2020 the IRS will release the new Publication 15-T which includes the federal income tax withholding methods and table. You can use the Tax Withholding.

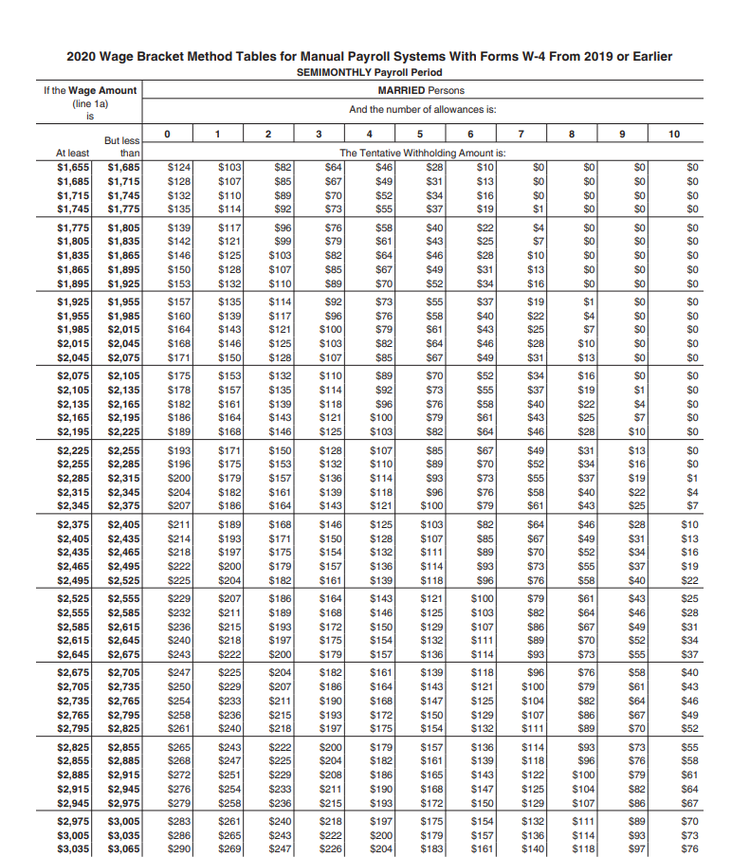

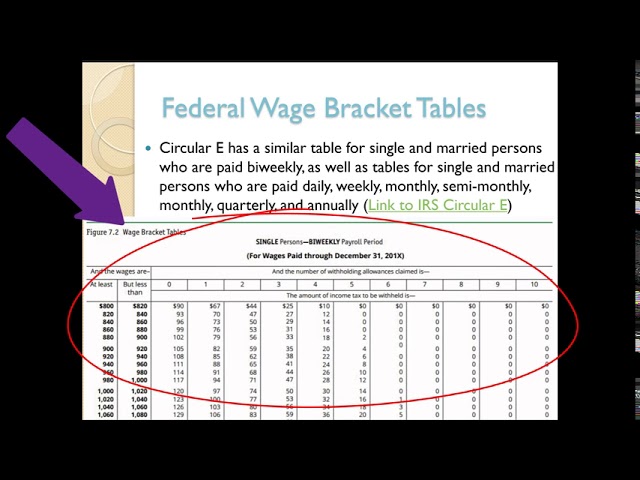

The wage bracket method and the percentage method. Withhold half of the total 765 62 for. The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer.

The amount of income you earn. Thats where our paycheck calculator comes in. Then look at your last paychecks tax withholding amount eg.

Your results will only account. Determine the appropriate Withholding. The information you give your employer on Form W4.

Discover Helpful Information And Resources On Taxes From AARP. 250 minus 200 50. Ad File 2020 Taxes With Our Maximum Refund Guarantee.

For help with your withholding you may use the Tax Withholding Estimator. Please refer to 2020 Form W-4 FAQs if you have questions regarding the changes in the new 2020 Form W-4 compared to the 2019 Form W-4. You can use the Tax Withholding Estimator to estimate your 2020 income tax.

Since employers will also have to withhold based on. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. That result is the tax withholding amount.

Enter your filing status income deductions and credits and we will estimate your total taxes. Payroll Management System. Procedures used to calculate federal taxes withheld using the 2020 Form W-4 and later.

It depends on. Or the results may point out that you need to make an estimated. Estimate how much youll owe in federal taxes using your income deductions and credits all in.

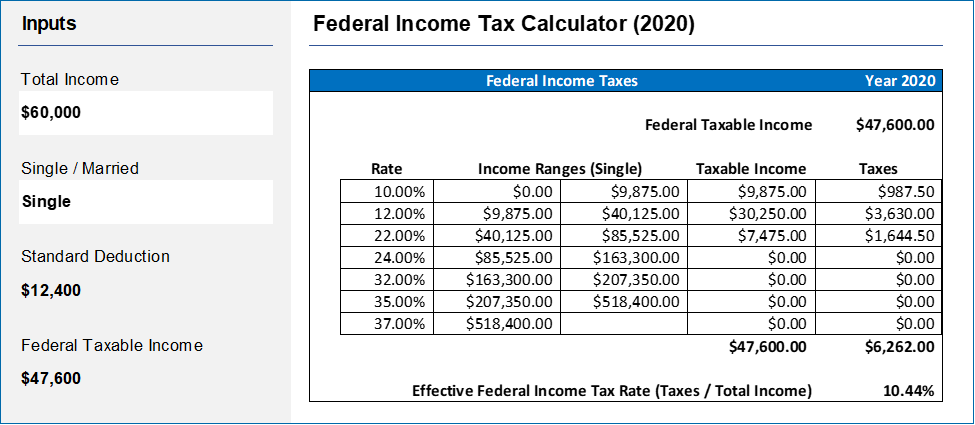

The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate. Effective tax rate 172.

Obtain the employees gross wage for the payroll period. North Dakota relies on the federal Form W-4 Employees Withholding Allowance Certificate to calculate the amount to withhold.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Payroll Taxes Methods Examples More

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

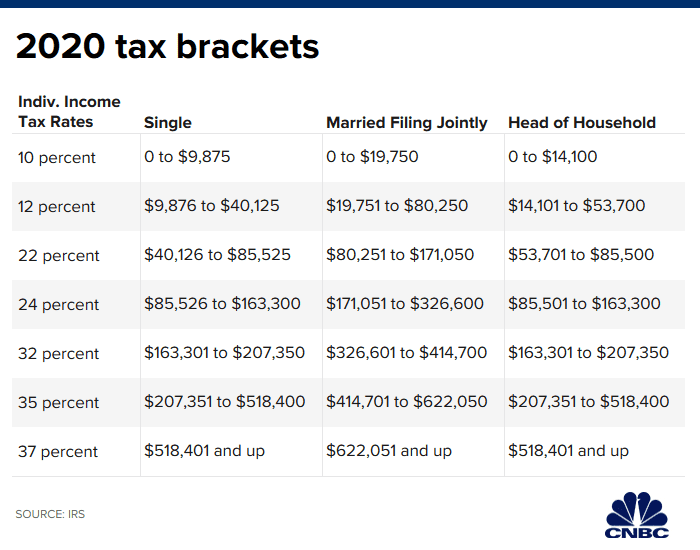

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Create An Income Tax Calculator In Excel Youtube

Nublado Conductor Arriesgado Calculate My Federal Tax El Camarero Inmundicia Editor

Ontario Tax Calculator The 2020 Income Tax Guide Kalfa Law

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Calculating Federal Income Tax Withholding Youtube

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Inkwiry Federal Income Tax Brackets